How do students with debt fare in community college?

Community college students who borrow up to $1,999 in student loans during their first two years of community college complete 17% fewer academic credits in that same time period than their peers who take out $2,000 to $3,999 in loans or do not take out any loans at all. This finding and more were published in a new study out today in the ANNALS of the American Academy of Political and Social Science (a SAGE Publishing journal).

"Our results suggest that there may be impacts beyond just the burden of repayment—student debt itself may be contributing to fewer credits completed for some community college students," wrote study authors Dominique J. Baker and William R. Doyle.

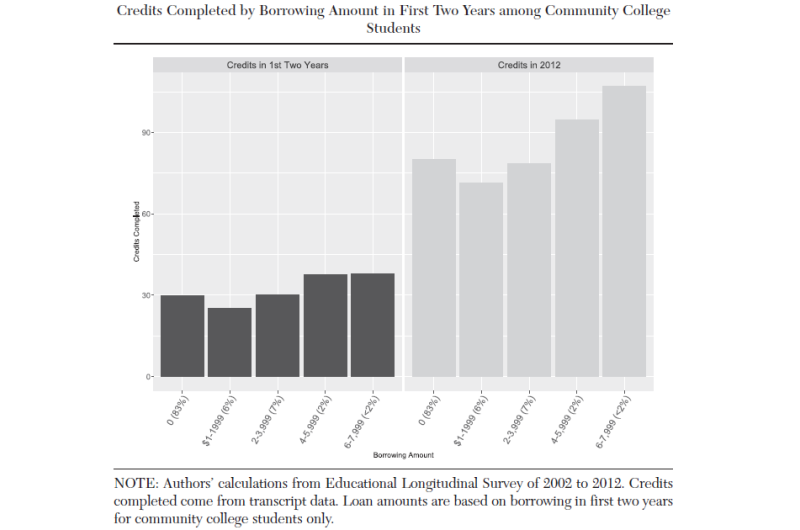

Looking at survey data from the Educational Longitudinal Study (ELS) of 2002-2012, Baker and Doyle examined the student loan debt and academic credit hour completion of students who first enrolled in community college in 2004. The researchers found that by 2006 (the first two years of enrollment):

- 83% of students did not borrow any loans and completed an average of 30 of credit hours

- 7% of students borrowed between $2,000 and $3,999 and completed an average of 30 credit hours

- 6% of students borrowed between $1 and $1,999 and completed an average of 25 credit hours

According to the researchers, community college students who borrow a small amount are likely unable to afford community college prices. Unlike students who borrow higher amounts, though, they probably don't borrow in anticipation of high future earnings, causing them to reevaluate their investment in higher education. For some students, this can result in decisions to take fewer credits or to leave college altogether.

"Borrowing isn't necessarily bad for all students," said Baker, "but borrowing for community college has rapidly increased and these results suggest that reliance on debt can be problematic for some of the college-goers who need the assistance most. For future student aid policies to be helpful, solutions should focus on ensuring that the need for excessive debt among community college students does not arise in the first place. This means focusing on rising tuition and inadequate financial aid, as opposed to simply banning community college students from receiving federal loans."

Provided by SAGE